In today’s MetaTrader 4 / 5 tutorial, we’ll take a look at what are Fibonacci levels and Fibonacci extensions, as well as I’ll talk about the accumulation of Fibonacci levels and what signals they are give to a trader who trades according to the rules of forex graphical analysis

I will not go into history and describe why Fibonacci is applicable to Forex, but I will only tell you why in many Forex strategies of this site we use these same Fibonacci levels.

And so the Fibonacci levels

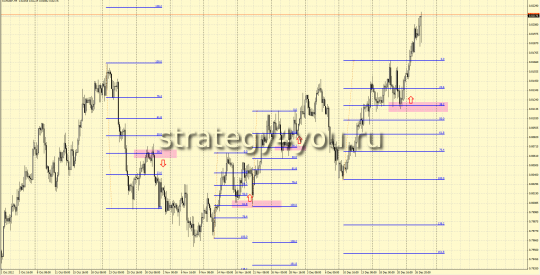

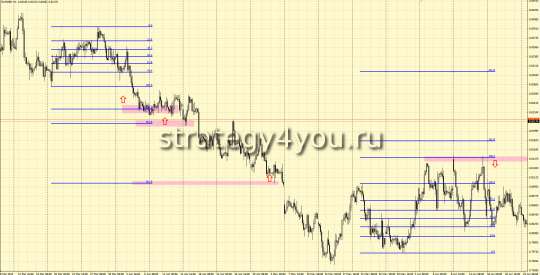

is a tool in MetaTrader 4 that we stretch over at least 2 important extremes (i.e. 2 explicit lows or 2 highs), in the direction of a trend move or the last move.

At the same time, important Fibonacci levels located between the levels of 0 and 100, which are: 23.6%, 38.2%, 50%, 61.8%, 76.4% will give the price stop levels at least temporarily, which can develop into a correction or even a trend reversal and movement in the direction of the main movement, along which the Fibo levels were stretched.

Fibonacci extensions

— these are additional levels located beyond level 100: 138.2%, 161.8%, 200%, 261.8%, etc. These levels also in the future, in the presence of additional signals, can give price stop points at least.

Fibonacci is sometimes referred to by professional traders as the «Best Trader’s Indicator» even though it is not! But nevertheless, it gives signals quite accurately at its important levels that this is exactly the level where the price will try to correct!

The most important Fibo levels for many currency pairs are: 38.2% and 61.8%, sometimes 50%.

Fibonacci zone:

If, when stretching several Fibonacci at different extremes, several important levels coincide, then such zones are called the «Fibonacci Congestion Zone» and they are even more important than 1 separate level.

It is also worth remembering that the older the time interval of the currency pair and, consequently, the built Fibonacci, the more important it is compared to the small Fibonacci levels.

Fibonacci levels are also symmetrical: that is, 23.6 is symmetrical to 76.4 and 38.2 is symmetrical to 61.8 (if we take the Fibonacci reference point from the other side, that is, stretch not in the direction of travel, but against). In other words, stretch the Fibo from the minimum to the maximum of the same movement and then vice versa — from the maximum to the minimum, and you will see that the levels match!

I personally constantly use Fibonacci in forex strategies, which I trade in both my analytical reviews and forex forecasts. That is, without it, I can’t imagine trading at all — it’s really an indispensable tool for trading in any financial market, including Forex!

Forex video lesson «Fibonacci in MetaTrader 4»:

Also about Fibonacci levels, you can watch a video lesson + examples of trading in my free video course «Basics of Forex Graphic Constructions», you first need to subscribe to receive it, but I think it’s worth it.