In one of the previous forex lessons on graphical analysis of this site, we talked about trend lines and partially mentioned forex & Crypto Сhannels.

Today we will take a closer look at parallel / equidistant channels and everything related to them: building channels, trading principles in them, breakout, retest them varieties.

And so the channels in the MetaTrader 4 forex terminal are of 4 types:

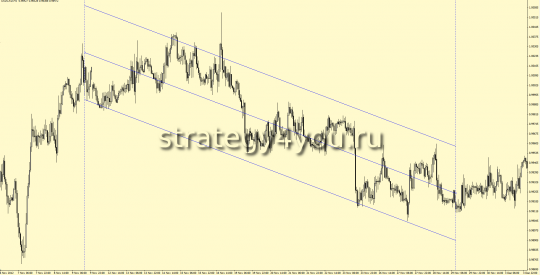

1) Equidistant channel — consists of 2 parallel trend lines and is the simplest of those considered. Learn more about it BELOW!

2) Fibonacci channel — I will not consider it in detail, since we have already studied it on this site. You can learn more about it at the link or watch the video tutorial:

3) Linear regression channel

It consists of 2 parallel lines, equally spaced above and below the constructed linear regression trend line. The distance between the upper and lower boundaries of the linear regression channel and the regression line is equal to the maximum deviation of the closing price from the regression line.

In this channel, in the same way, 2 channel lines are support and resistance lines, if the price does not break through one of the lines for a short time, then this indicates a possible trend change in the market.

In my practice of graphical analysis and in trading, I do not use it, so I will not dwell on it in detail.

4) Standard deviation channel

It is built in a similar way, but the distance between the boundaries of the channel under consideration and the regression line is equal to the value of the standard deviation of the closing price from the regression line. In this channel, the middle trend line is, as it were, the “equilibrium price” line, if the price is trading above it, buyers are more active in the market, if below it, sellers are more active.

I also do not use this equidistant channel when analyzing the market and in my trading.

Let’s take a closer look at Equidistant/Parallel Channel:

Here is a useful video about this channel, I recommend watching it:

Trading principle:

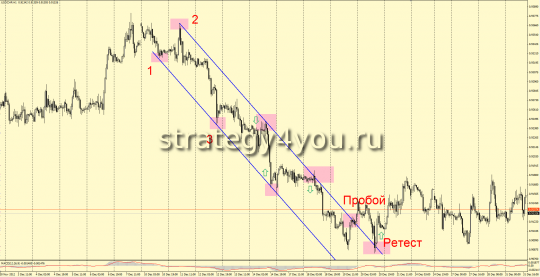

Since it is built on at least 3 points, it is desirable that the 3rd (opposite point) is between the 2nd, through which we build a support and resistance line (that is, points 1, 2 and 3 alternate in formation time).

This is a desirable condition for building a channel, but not mandatory, it is possible to trade without observing it, but in this case, trading is accompanied by even greater risk!

- If this condition is met, then at the 4th approach of the price to the opposite trend line of the channel under consideration, a rebound is most likely.

- If this condition is not met, then the opposite trend line is only a desirable target line, that is, the line towards which the price tends and a rebound from it is of course possible, but with a lesser degree of probability.

Although I do not always try to use this rule, nevertheless I distinguish for myself how the channel is built on the chart of the currency pair and what can be expected from it.

You can trade:

- as inside the channel, from its borders,

- and after its breakdown — from the channel border.

You will learn more about the principles of channel trading in the following forex strategies:

- Parallel channels in forex

- Forex strategy «Flag + ABC» — trading on limit orders using the channel

Trading on Channel Breakout

The breakout of the channel usually indicates a change in the trend in the market to the side (that is, the beginning of a corrective movement) or to the opposite. To identify a breakout, as well as for a trend line, it is necessary to wait for the candlestick of the considered interval or an older time interval to close.

If the price returns to the line of the broken channel, then this return can be considered as testing the broken line for strength, and if the price bounces off it, then this is a forex channel retest.

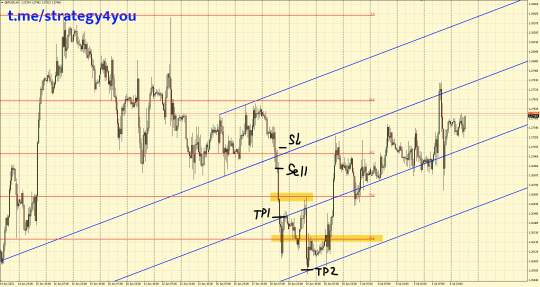

Channel — as a target for setting a profit

Very often, the channel can be used as a target for finding a profit point, as shown in detail in the video posted above. And here I will just publish an example in the photo, and you test this method yourself and write, did you like this way of finding profit?

I personally almost always build channel projections and look for where to take profit, and often this method is the best for predicting price movement, stopping and reversing / rebounding from the channel line.