Today we will look at 12 ways to set a stop loss for various forex strategies or cryptocurrencies of this site with examples and videos.

- The first important rule: always set a stop loss!

- The recommended stop is 0.5-1% (desirable for beginners) and 2-3% (average for most strategies).

Options for setting a stop loss order:

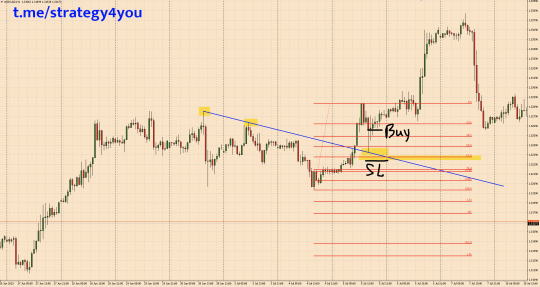

1) Beyond the trend line, channel (under the line, which the price has broken upwards when buying and above the line, when it breaks down).

Useful related links:

- Forex & Crypto Channels: Main types, How to build, How to trade and make a profit

- Trend line: what is it in Forex, what shows the trader, what is it for, how to build it correctly

2) For an important Fibonacci level / Fibonacci congestion zone

Useful links:

3) Beyond the extreme — under the last (closest to the price) minimum / maximum in the direction of travel. It is also possible to install under the Fractal.

Useful links:

4) For indicators (moving averages, PSAR, etc.)

Example:

Example:

Useful links:

- Trailing stop 7 in 1 — get it for free (in telegram channel) ➜

- Trailing stop universal: 7 types of order tracking + script for placing orders on the news (description + video on installation and use) ! (instruction and video in Russian, use the google translator)

5) Fixed number (tested on history, for example), just the average retracement range for this pair

For example, for EURUSD: 20-30 points, for GBPUSD — 50 points.

6) For an important level / extreme (high or low)

7) For daily or weekly high / low

Often used in long-term strategies, for example in:

- Daily

- Weekly

- or in breakouts

8) By pivot levels (for him)

Useful links:

9) According to graphic patterns

- WW — behind point 5 and line 1-3-5,

- H&S (Head and Shoulders) — behind the neck line + right shoulder,

- Triangle — last high / low, etc.).

Example 1 — Head and Shoulders:

Example 2 — Pennant:

Useful information on the topic:

10) For the retest and lights out candle (almost like point 3). Often this is a PIN-BAR.

Useful links:

11) By Stop trade (positive stop). The stop loss is moved in the positive zone as the price moves in your direction: first to breakeven, then n plus under important extremes and levels. Trailing stop is often used.

Useful links:

12) Putting a stop loss at breakeven.

You should also always remember that:

Video — 12 ways to set a stop loss:

If you have any comments, ways, write in the comments!